A Guide to Maternity Insurance in Singapore 2026

Time to read 5 min

Time to read 5 min

Maternity insurance (also known as pregnancy insurance) is one of the many things you’ll need to consider when you are expecting. Thinking about worst-case pregnancy scenarios and birth defects can be mood-dampening to your pregnancy, but making a decision to purchase maternity insurance is a necessary thought process that all expectant parents should go through.

Disclaimer

All information provided is accurate as of October 2023, and opinions made are my own. Please seek advice from a qualified adviser before buying any insurance product. This is not a sponsored post.

I have the permission of my trusted AIA insurance agent to disseminate this information. If you need any qualified insurance advice, feel free to reach out to James Ng, 9185 9025, james.ng@aia.com.sg.

In Singapore, maternity insurance is specially designed to offer a lump sum payout or daily hospital allowance in the event that you experience pregnancy complications or your newborn gets diagnosed with any congenital illnesses.

Maternity insurance does not cover the cost of delivery or your hospitalisation bills. It also does not cover antenatal check-ups and scans. It mainly covers unexpected situations like pregnancy complications, congenital conditions of the baby, and any medical negligence due to childbirth. The list of inclusions will vary depending on the plan you purchase.

There are two types of maternity insurance plans: standalone maternity insurance plans and a maternity rider that accompanies a base plan (that is usually transferrable to your newborn).

Your maternity insurance will provide you with coverage until the end of your pregnancy term. If you choose a maternity rider with a base plan, this base plan will remain with the mother and continue to cover her for life.

Expectant mothers between 13 to 36 weeks pregnant can purchase maternity insurance. Regardless of how far into your pregnancy you are, you pay the same premium.

All Singaporeans and Permanent Residents are automatically covered under MediShield Life from birth for life, even if they have congenital and neonatal conditions. As it’s meant to be a type of affordable basic insurance, there are coverage limits for various treatments, hospitalisation, surgery and outpatient treatments.

As maternity insurance is designed for a pregnant mother’s needs, you can expect to be covered for more pregnancy and childbirth-related complications, and even developmental delay in the child.

Overall, a maternity insurance plan is not a necessity. It is a good complement to your existing insurance plans, as the payout will be made on top of your existing coverage.

Most of Singapore’s main insurance providers, AIA, Prudential, Great Eastern, and Manulife, offer maternity insurance plans that are more or less similar (just like credit card deals). Which you choose highly depends on your preference of provider, and many mothers choose to buy a maternity plan from their existing agent, for the sake of familiarity and trust.

If you do not have an existing insurance agent to contact, there are flocks of insurance agents at maternity expos who will be happy to share more with you. Nonetheless, it is very important to choose a trustworthy insurance agent who will be there if you need to make a claim, and who will not use this opportunity to upsell you with the use of fear tactics.

As I have existing insurance plans with AIA, am familiar with the AIA phone app, and am comfortable with my existing AIA insurance agent, AIA was my first and only choice for a maternity plan.

AIA does not have a standalone maternity plan. What this means is that my only option was to get the pre-natal rider with a base plan.

Depending on the amount of coverage you require, the one-time premium will differ. The coverage amount is a one-time payment, and can only be claimed once for the mum, and once for the baby. The coverage amount is stackable on top of the hospital care benefit, claimable separately for mum and baby.

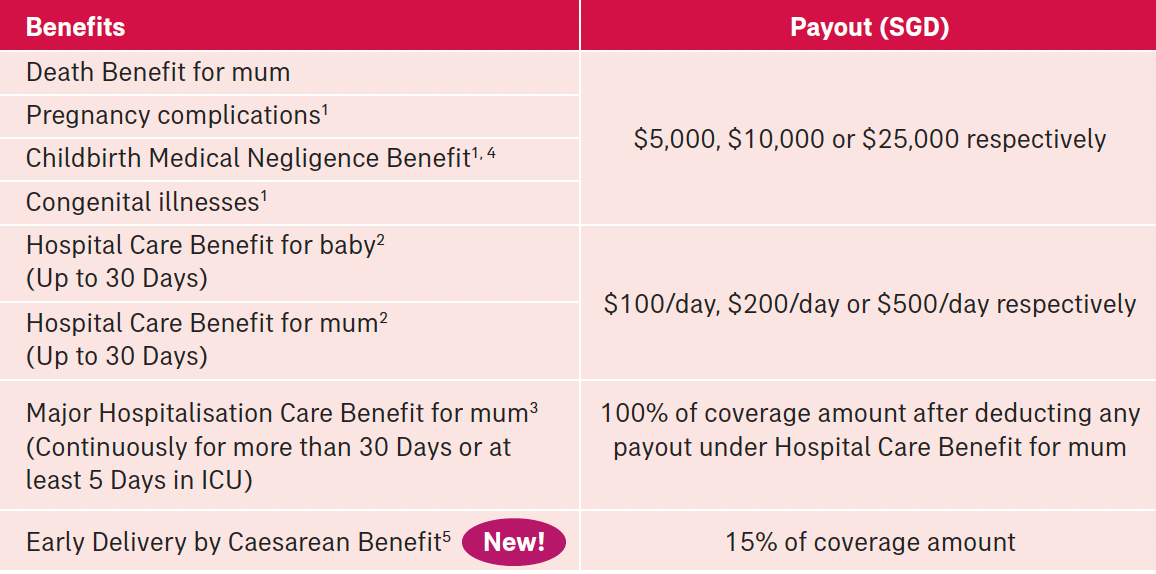

Here’s a list of benefits, pregnancy complications and congenital illnesses that are covered by pre-natal rider (as of October 2023).

Benefits Payout:

List Of Covered Conditions - For Mum:

List Of Covered Conditions - For Baby:

Coverage Amount |

Hospital Care Benefit (Up to 30 days) |

One-Time Premium |

| $5000 | $100 | $460 |

| $10,000 | $200 | $920 |

| $25,000 | $500 | $2,300 |

Example 1: 2 pregnancy complications + 1 birth congenital defect

For example, Mum A bought a maternity rider with $10,000 coverage. She unfortunately suffered from 2 pregnancy complications, so she will only be able to claim $10,000, and not $10,000 x 2. In addition, her baby also, unfortunately, suffered from a congenital defect, she will also be able to claim $10,000

In total, she would be able to claim $10,000 (pregnancy complications) + $10,000 (birth congenital defect) = $20,000.

Example 2: Maximum claim scenario

This is a highly extreme situation, and is just for illustration purposes.

This is a whole-life plan with lifelong coverage till age 100, covering death or total permanent disability or all stages of critical illnesses.

To start on your parenthood journey, shop Hatchery Cribs' range of nursing chairs, breast pumps, and nursing cushions that will be perfect for the precious months ahead. Shop here.